Digital Tipping at Low Dollar Amounts

A potential approach for low-dollar tipping that assuages some micropayment concerns

I traveled again last week (which is why there was no newsletter last week, sorry about that) and the item that stuck out most to me from my previous grab-bag is low-dollar digital tipping. What I said in that article is still true: the best option here would be for the hotel chains to build this kind of functionality into their apps and billing system and distribute to their staff. But, I think that’s unlikely and I’m far from an expert in hotel systems.

The issue with any recommendation that doesn’t involve the hotel (or any kind of larger organization) managing the process is that you’re now talking about a micropayments solution. And micropayments seem to be the consistent third-rail of digital products. I want to spend some time talking about the issues with micropayments and explore a potential solution based on a little-known Google product’s approach.

The Problem with Micropayments

There’s been a ton written about micropayments on all sides of the argument from all kinds of sources. This won’t be a full literature review, but I do want to hone in on what I see as the core problem and haven’t seen talked about very widely.

A Brief Lit Review

The first thing you’ll notice diving into this topic is that most payments companies define a micropayment as anything below the $5-$10 range, and that’s way high for what we’re talking about here. For average transactions around the $2 range, you’ll sometimes see the term “nanopayment” used instead, though that term often refers to payments in cents.

If you do want a bit of a deeper dive, I recommend starting with things written in 2021 or later; there was a boom of micropayment conversation in the early aughts that can still be interesting, but the landscape has changed so drastically since then that I don’t find anything more than a few years old to make a compelling argument now - it’s all focused more on a web architecture that no longer exists, and while the theories are still interesting and have legs there’s just no real application anymore.

This Investopedia article is a good overview, and it even includes the wallet accrual concept that I’m about to dive into. Basically, it steals my thunder. This Forbes article focuses more directly on publishing, an industry for which micropayments are frequently discussed as a mythical cure-all to the business model. This Axios story takes the pessimistic view of the same issue, but more focused on how micropayments may not really create a new middle class of digital creators (I’m surprised Substack isn’t called out directly there, honestly…). Crypto long promised to be the savior here, though that seems less likely by the day. This overview is a decent way to understand why they thought they could win here, though.

The Real Problem - Payment Processing is Hard and Expensive

I am not a payments expert by any means, but I have implemented and worked across several payments processors in previous roles and it’s never as easy or cheap as it should be. If you want to take credit card payments, you’re in for a tough initial implementation if you can’t code. And often, even if you can. Ease of payments setup is a HUGE advantage of Substack and one of the main reasons I moved here from a traditional WordPress setup.

But anyone invested in truly tackling a person-to-person scaled micropayment solution would be able to solve the technical problems if they build on one of the big providers like Stripe. But then, they have to pay Stripe’s fees: 30 cents and 3% per charge. Under that structure, a 50-cent payment leaves only 18 cents for the recipient. A dollar leaves only 67 cents. And that 67 cents needs to cover the application costs somehow too - the app can’t be free here. At lower dollar amounts, that math really doesn’t math.

So, you may just have to build your own payment processor, another third-rail of digital development. If Amazon moves to Stripe and stops managing its own payments, what shot does a bootstrapped startup focused on very low-dollar transactions have? They’re not good. That’s why everyone got excited about crypto wallets in this space, because then you’re not running a credit card. But since FTX collapsed, there’s a lot less talk about that. But, that’s thankfully not the only option left.

The Google Opinion Rewards Approach

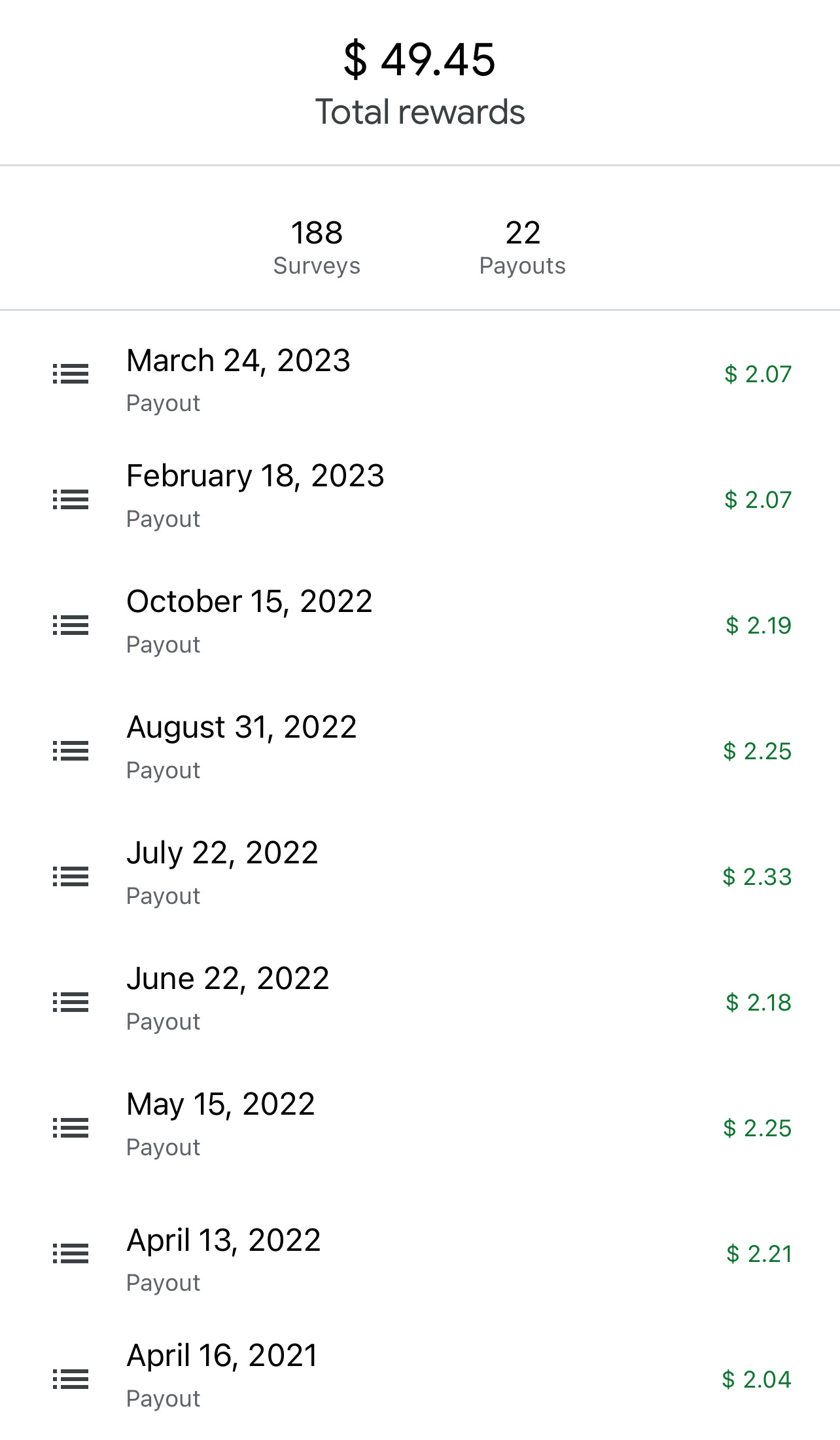

In 2013, Google launched an app that pushes out short surveys to users who are paid a few cents for their responses called Google Opinion Rewards (GOR). I’ve taken about 200 of these and have made about $50. That’s the kind of truly micro payment I’m talking about enabling at scale. Google makes this work by only paying out once the payment threshold crosses $2, and they process that payment via PayPal (at least on iOS - for Android, you’re stuck with Google Play credit which really sucks).

Now I don’t want to talk about the privacy concerns involved here (I’ve long accepted that Google knows absolutely everything about me based on my 14 years of email and daily Maps usage). And I don’t want to talk about its use of generally poorly-designed surveys that these days just seem to want to confirm Maps location accuracy and that’s all.

I just want to appreciate the approach - Google figured out that they could make direct account transfers via PayPal and be profitable at a transaction total of ~$2, so they just hold everything in an inaccessible escrow until you get to that total. And they’re obviously doing this at scale - the app is pretty much always in the top 100-ish. There’s something here in GOR that might be able to be applied to a digital tipping situation.

Applying the GOR Concept More Broadly

If a digital tipping solution wants to succeed based on the GOR lessons, then these 2 core features stick out:

An escrow account for every relationship that only clears once it crosses a certain threshold

A payments system that goes account-to-account and avoids credit card processing completely

#1 - The Escrow Account

GOR’s $2 feels about right. But a complication of applying this more broadly is that I’m not sure how many times any single person is going to be tipping any other single person in this structure; GOR works because Google is consistently paying each User, but would I be tipping the same housekeeper every night at the hotel? Probably not.

So, there are 2 possible workarounds I see to that problem, with the first being much easier to implement than the second:

Don’t allow payments below the otherwise-escrow threshold (i.e. minimum tip is $2)

Establish the payee account as a shared resource among a set group with distribution rules set at the account level (i.e. all housekeepers share the sam1e account and each then get an even distribution at each payout)

For scale and true “micro” enablement, I think 2 is the right approach here. But, it’s harder and more expensive. Launching with 1 feels like a great MVP approach. The question becomes: can you differentiate the experience enough from someone just sharing their own Venmo handle everywhere to justify your place as a middleman?

#2 - Account-to-Account Without Cards

This is really the trick to the economics here, because payments directly to other accounts without a credit card as an intermediary are so much cheaper. For PayPal specifically, direct account-to-account payments are a flat 3% with no fee. So if you send $2, the recipient gets $1.94. If you need a QR code intermediary (which would help enable discovery in a physical space, like the bell stand), there’s a 5-cent fee but the percentage is down to 2.4%. That same $2 transaction leaves the recipient $1.90 here. Both much better than Stripe’s $1.64.

Let’s say the app promises $1.50 of every $2 to the true recipient - the app keeps ~40 cents of the PayPal transactions but only ~15 cents from Stripe transactions. That extra 25 cents is going to go a long way in actually funding the company behind this thing.

The obvious downside here is that everyone involved in the transaction needs an account on the same system; PayPal is everywhere, but its still dwarfed by the number of Credit Cards in the wild. And there’s another step to actually move the money from the app account to your actual bank (though PayPal has some rules that will automatically transfer balances which is a great feature).

Summary

A digital tipping solution could leverage the lessons of Google Opinion Rewards to build a micropayment network at scale. To do so, it would need to handle a minimum payment threshold and find the right way to execute payments account-to-account, avoiding credit card payments entirely. The app would face challenges in adoption based on the account requirement and would need to prove more usable and useful than simply sharing your own Venmo handle directly.

I’ll dive into how you could tackle those challenges sometime soon - I’m getting dangerously close to trying to build something here…